UK interest rates cut to 4% in tight decision

Business reporter, BBC News

EPA

EPAThe Bank of England has narrowly backed an interest rate cut in a knife-edge move after it had to vote twice to reach a decision.

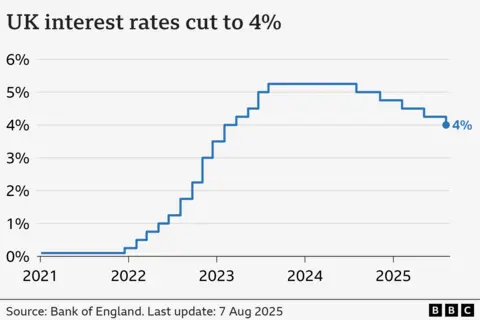

The cost of borrowing has been reduced from 4.25% to 4% in the fifth cut since last August.

But the Bank’s unprecedented second vote by policymakers suggests further interest rate cuts will be finely balanced amid concerns that inflation will spike as businesses increase food prices to pay for higher employment costs.

The cut in interest rates will reduce monthly mortgage costs for some homeowners but it could also mean smaller returns for savers.

Inflation is now expected to peak at 4% in September, the Bank said in its Monetary Policy Report. That is twice the Bank’s target rate and above the 3.8% rate it predicted in its May report.

Andrew Bailey, governor of the Bank of England, said the decision to cut interest rates was “finely balanced”.

“Interest rates are still on a downward path,” he said. “But any future rate cuts will need to be made gradually and carefully.”

Businesses told the Bank that “material increases” in National Insurance Contributions and the national living wage since April have added up to 2% to food prices.

The Bank said global adverse weather conditions had also lifted the cost of goods such as beef, coffee beans and cocoa.

But companies told the Bank that they expected UK labour costs “to continue to push up food prices in the second half of the year”, and new packaging regulations will also have an effect.

Businesses said that in order to mitigate costs, they were having to cut staff.

They also reported that shoppers were “trading down” by purchasing own-label items as opposed to branded products.

Customers are increasingly buying “cheaper cuts of meat” and purchasing food staples in larger value packs.

At 4%, interest rates are now at their lowest level since March 2023. This will boost some mortgage-holders and borrowers, but it is likely to mean smaller returns for savers.

People with tracker mortgages, which are loans that track the Bank’s base rate, should see an immediate reduction in monthly repayments. There about 600,000 people who have one.

The latest cut in rates means repayments on an average standard variable rate mortgage of £250,000 over 25 years will fall by £40 per month, according to financial information company Moneyfacts.

‘We are still a little bit anxious about the future’

However, there are many homeowners who are having to remortgage this year at rates higher than deals they struck several years ago.

Adam Christie has just had to re-fix his mortgage rate – moving from a five-year fixed term with a 1.8% interest rate, to a two-year term with a rate of 3.8%.

“It was quite a significant jump, but not as much as we were fearing,” he tells the BBC.

Christie had been prepared for a £200-300 per month increase – but instead his repayments have risen by about £100.

While he describes this as “the best of a bad situation”, he adds there is still uncertainty about the future.

“We are still a little bit anxious about the future and what it might hold. They might go up again… but I suppose only time can tell,” he says.

The Bank’s nine member Monetary Policy Committee was split on the decision to cut rates. Four members wanted to cut rates, four wanted to hold and one – Alan Taylor – wanted a steeper reduction in borrowing costs.

Some economists had been expecting a further interest rate cut at the Bank’s meeting in November, but the tightness of the latest vote has led some analysts to cast doubt on whether this will happen.

“Bank of England policymakers are still playing a highly cautious hand,” said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

“Although the Bank has opted for a cut, the chances of another reduction by the end of the year have receded sharply,” she added.

Ruth Gregory, deputy chief executive at Capital Economics, said the Bank “appears in no rush to cut again”.

She said the policymakers’ analysis of risks to the economy “raises the chances that the Bank will skip a cut later this year”.

Chancellor Rachel Reeves said the drop was “welcome news, helping bring down the cost of mortgages and loans for families and businesses”.

However, shadow chancellor Mel Stride said interest rates “should be falling faster”, adding: “Rates are only coming down now to support the weak economy Rachel Reeves has created.”

Liberal Democrat Treasury spokesperson Daisy Cooper said the cut “would have happened months ago if the government was not acting as a roadblock to growth”.

The Bank now forecasts that GDP figures for the April-to-June quarter, due to be published next week, will show a sharp slowdown to just 0.1% growth.

That compares to 0.7% expansion in the first three months of this year.

It also said the impact of US tariffs on the UK is not expected to be as much as it thought back in May.

However, tariffs are expected to dent economic growth to the tune of 0.2%.

Get our flagship newsletter with all the headlines you need to start the day. Sign up here.

[title_words_as_hashtags