$MNT Bulls Charge Past $0.91, But Overheated RSI Warns of Consolidation

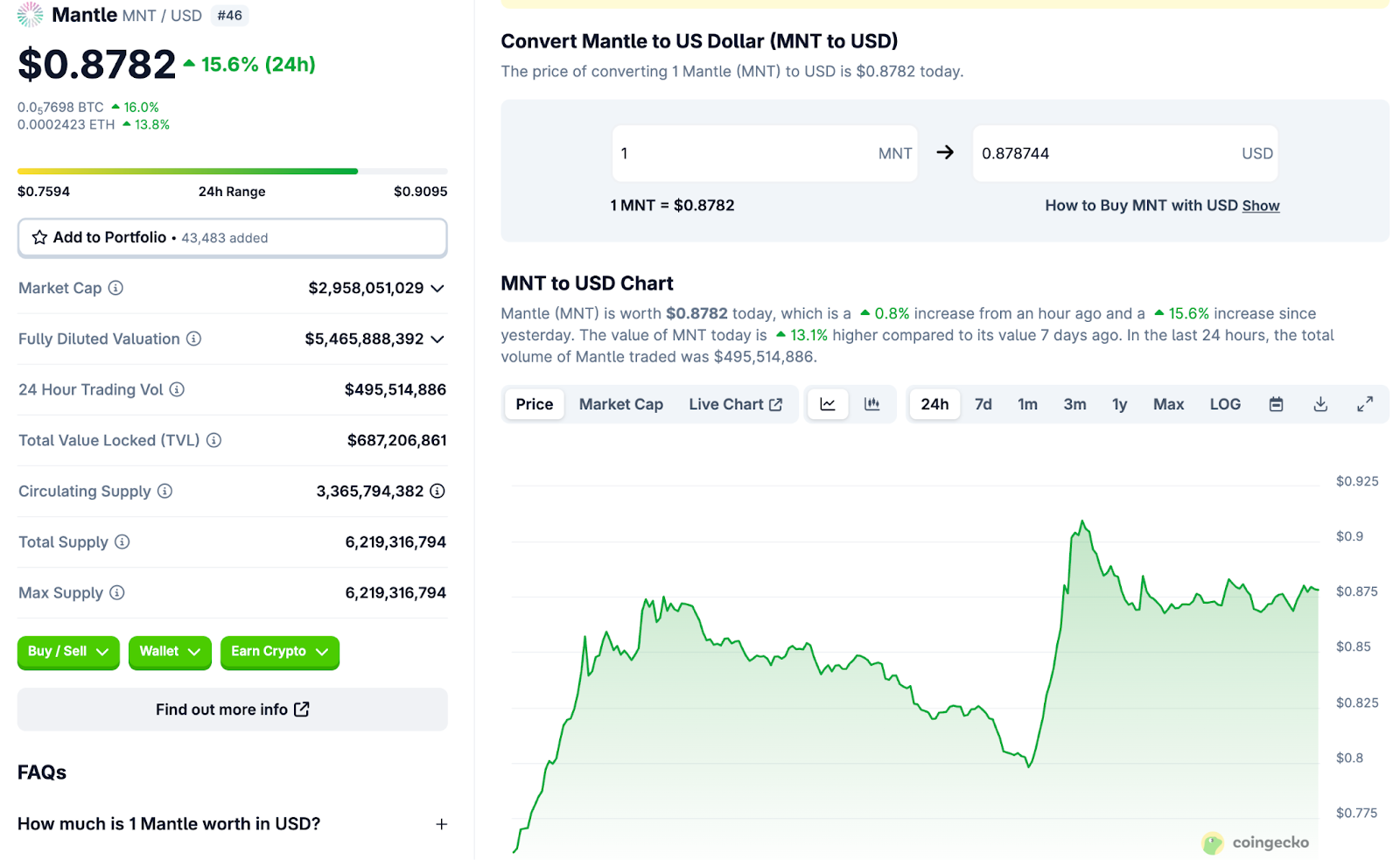

Mantle’s $MNT token jumped 15.6% to $0.91 as traders piled into the Layer-2 network amid surging DeFi activity.

While the asset’s technical indicators show the move may be overheating, the broader picture reveals a network gaining serious traction. With major upgrades rolling out and key partnerships forming, Mantle appears to be hitting its stride at just the right moment in Ethereum’s scaling race.

Mantle Hits $2.95B Market Cap: Can It Overtake Top L2s?

Mantle is a modular Layer-2 scaling solution for Ethereum, built on Optimistic Rollups and integrated with EigenDA to enhance data availability and security.

Since its mainnet launch in July 2023, Mantle has rolled out OP-Stack upgrades, including meta-transactions and fee optimizations, and launched the Mantle Ecofund, allocating $200 million for developer grants to drive DeFi, gaming, and AI innovation.

As a utility and governance token, $MNT pays for transaction fees and on-chain voting and currently has a market cap of more than $2.953 billion.

A flurry of partnerships and product launches has put Mantle Network squarely in the spotlight in the last few months.

Since its February 2025 integration with Chainlink Scale, Mantle has operated live Data Feeds and Data Streams on mainnet, allowing decentralized oracle data at high throughput for smart contracts.

Under the hood, Mantle’s technical architecture has made strides in both throughput and security.

In March 2025, Mantle became the first major L2 to fully integrate EigenDA, expanding its data availability operators from just 10 to over 200 and slashing trust assumptions in favor of economic security.

Gaming and DeFi projects continue to flock to the platform: the April Games Fest spotlighted HyperPlay titles, while AI-driven platforms like Funny Money and cross-chain swaps via Bungee have gone live as part of a broader push to make Mantle a true “liquidity chain.”

In April, Mantle launched the Mantle Index Four (MI4)—a $400 million, Securitize-backed institutional fund that tokenizes a diversified basket of Layer 1 and Layer 2 assets via on-chain minting and redemption mechanics.

These upgrades demonstrate a commitment to “progressive decentralization,” marrying high throughput with cryptographic guarantees.

On the incentives front, Mantle has kept users engaged with regular reward campaigns.

June’s Yapperboard Challenge Phase 2 doled out 50,000 MNT in weekly Discord rewards, and July 8 kicked off the $1.2 million MNT Reward Booster Season 3—locking MNT allows users to earn proportional shares of the prize pool through time-weighted snapshots.

This spurred further on-chain activity, reflecting robust adoption: Q1 2025 recorded about 650,000 daily active users and over 30 million transactions, according to Mantle’s own progress review, showing a vibrant developer and user base.

DeFi TVL stands at $233 million, up 2.4% in 24 hours, while bridging TVL exceeds $1.7 billion.

As Mantle pushes toward its v2 roadmap with ZK proofs and expanded DA bridges, the coming months are expected to be another proving ground for this fast-moving Layer 2.

Mantle Breaks Out Above $0.91, But Aggressive Sellers Return Near Session Highs

$MNT has extended its upward streak on the back of sustained demand, pushing to a high of $0.9207 before retreating slightly. What’s interesting with this move is the shift in volume dynamics across the 1-hour footprint and how the price responded to it.

During the early phase of the session, buy volume rose aggressively between $0.8650 and $0.8800 with supportive deltas in excess of 600K, which is indicative of committed spot and perpetual buyers lifting offers across multiple price levels.

This laid the groundwork for the impulsive move toward the $0.91 zone.

However, the character changed in the final two candles. The volume footprint showed that while total traded volume exceeded 3.9 million in the last hour, delta flipped sharply negative to -1.07M.

This goes beyond passive distribution; it was more of a direct selling into bids after a vertical rise. Such behavior often implies profit-taking or renewed supply entering the market, especially when it coincides with key round numbers like $0.9200.

The 4-hour price chart backs up the strength of the rally, as $MNT pushed well above its 20, 50, and 100 SMAs, all now stacked in proper bullish order.

The asset’s price has broken out of a falling structure and left behind a V-shaped recovery. That said, the RSI is approaching overheated territory, reading at 73.81, which historically warns of potential pause or pullback.

The MACD remains supportive of trend continuation, with the lines widening and histogram building upwards, but it’s already extended.

Momentum remains strong overall, but it’s worth noting the shift in effort versus result. Buyers had to expend more volume to push the price just a few cents higher toward the close. Unless fresh demand steps in above $0.9150, the risk of a local pullback grows.

$MNT’s price may revisit the $0.8800–$0.8850 area again to test whether recent buyers are willing to reload. If they do, the way toward $0.94 remains open. If not, we could see today’s high as a temporary ceiling.

The post $MNT Bulls Charge Past $0.91, But Overheated RSI Warns of Consolidation appeared first on Cryptonews.

[title_words_as_hashtags