ChatGPT’s XRP Analysis Flags $2.94 Support – Rebound Setup or Breakdown?

ChatGPT’s XRP analysis reveals a major -2.69% pullback to $3.0047, testing key 50-day EMA support at $2.9422, as the XRP Ledger ranks lowest for security among 15 blockchains in a new report, triggering institutional profit-taking amid $360 million in crypto liquidations.

XRP is showing a bearish MACD at -0.0290 but a positive histogram at 0.0593, suggesting momentum building, while RSI at 46.45 approaches oversold territory with a high 122 million XRP volume indicating strong institutional participation during the decline.

ChatGPT’s XRP analysis synthesizes 22 real-time technical indicators to assess XRP’s trajectory amid security concerns and key support testing between recovery continuation and deeper correction acceleration.

Technical Analysis: Major Pullback Tests Key Support

XRP’s current price of $3.0047 reflects a -2.69% decline from the opening price of $3.0877, establishing a volatile trading range between $3.0916 (high) and $2.9404 (low).

This 5.0% intraday range shows strong volatility typical of institutional repositioning following negative security reports.

The RSI at 46.45 sits in neutral-bearish territory approaching potential oversold bounce conditions, providing balanced positioning for possible reversal.

Moving averages reveal mixed positioning, with XRP below the 20-day EMA at $3.1042 (+3.3%) but maintaining strength above the 50-day EMA at $2.9422 (-2.1%), the 100-day EMA at $2.7218 (-9.4%), and the 200-day EMA at $2.4464 (-18.6%).

MACD shows a bearish structure at -0.0290 below zero with a signal line of 0.0304, but a positive histogram of 0.0593 suggests that momentum is being built toward a potential bullish crossover.

This momentum divergence during a price decline often precedes reversal moves as technical indicators prepare for directional shifts.

Volume analysis shows exceptional activity at 122 million XRP, indicating massive institutional participation during the selloff.

The ATR at 2.4120 suggests a high volatility environment with continued potential for major moves as the market processes the implications of security reports.

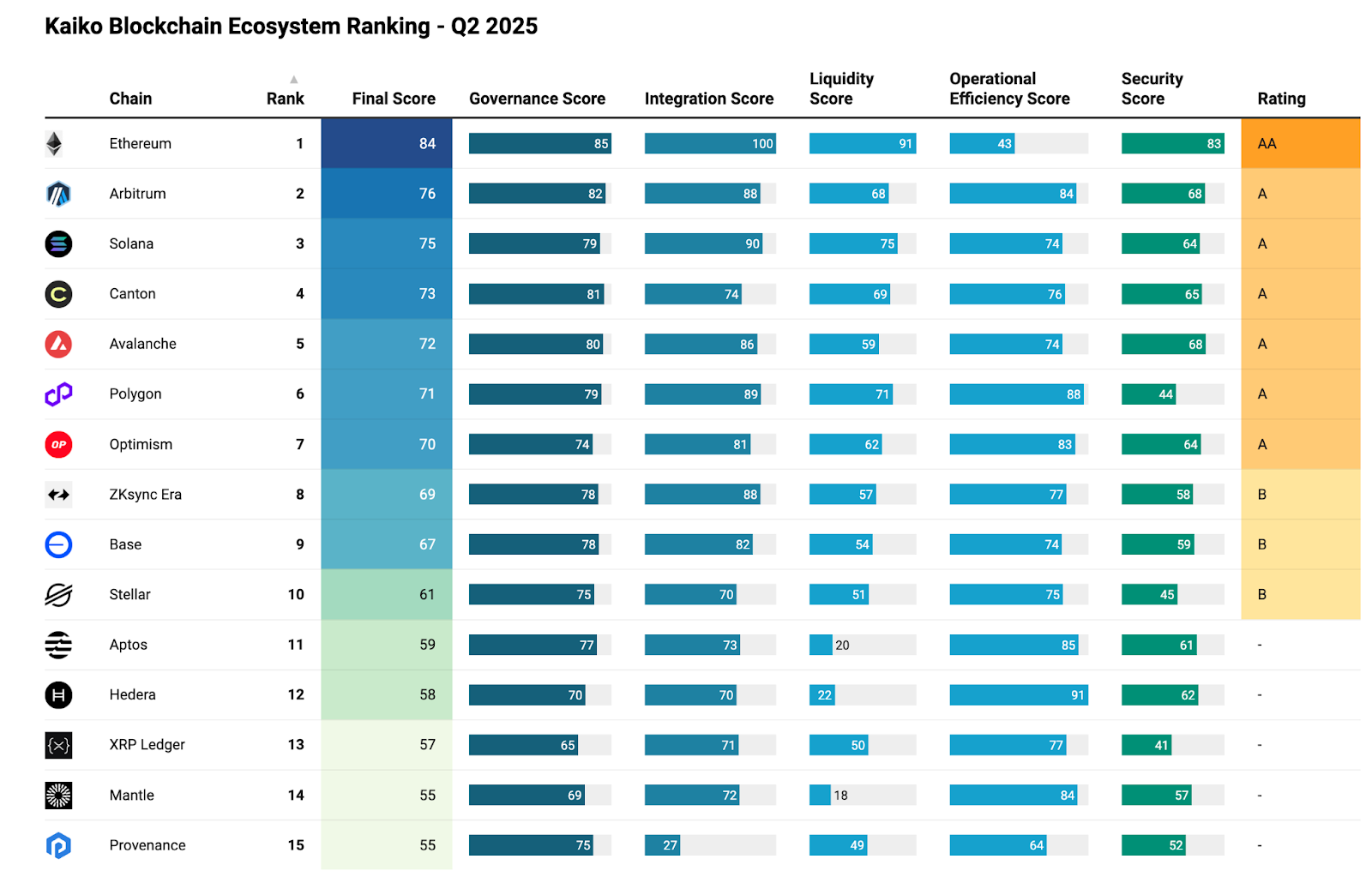

Security Report Creates Institutional Uncertainty

XRP’s pullback follows reports that the XRP Ledger ranks lowest for security among 15 blockchains in a comprehensive security review, creating institutional uncertainty about technical infrastructure reliability.

The measured -2.69% response reflects sophisticated institutional processing of technical assessment implications.

The broader crypto market experienced $360 million in long liquidations as Bitcoin fell below $116K, creating systemic selling pressure across institutional holdings.

XRP’s relative outperformance compared to broader market liquidations demonstrates underlying fundamental strength despite security concerns.

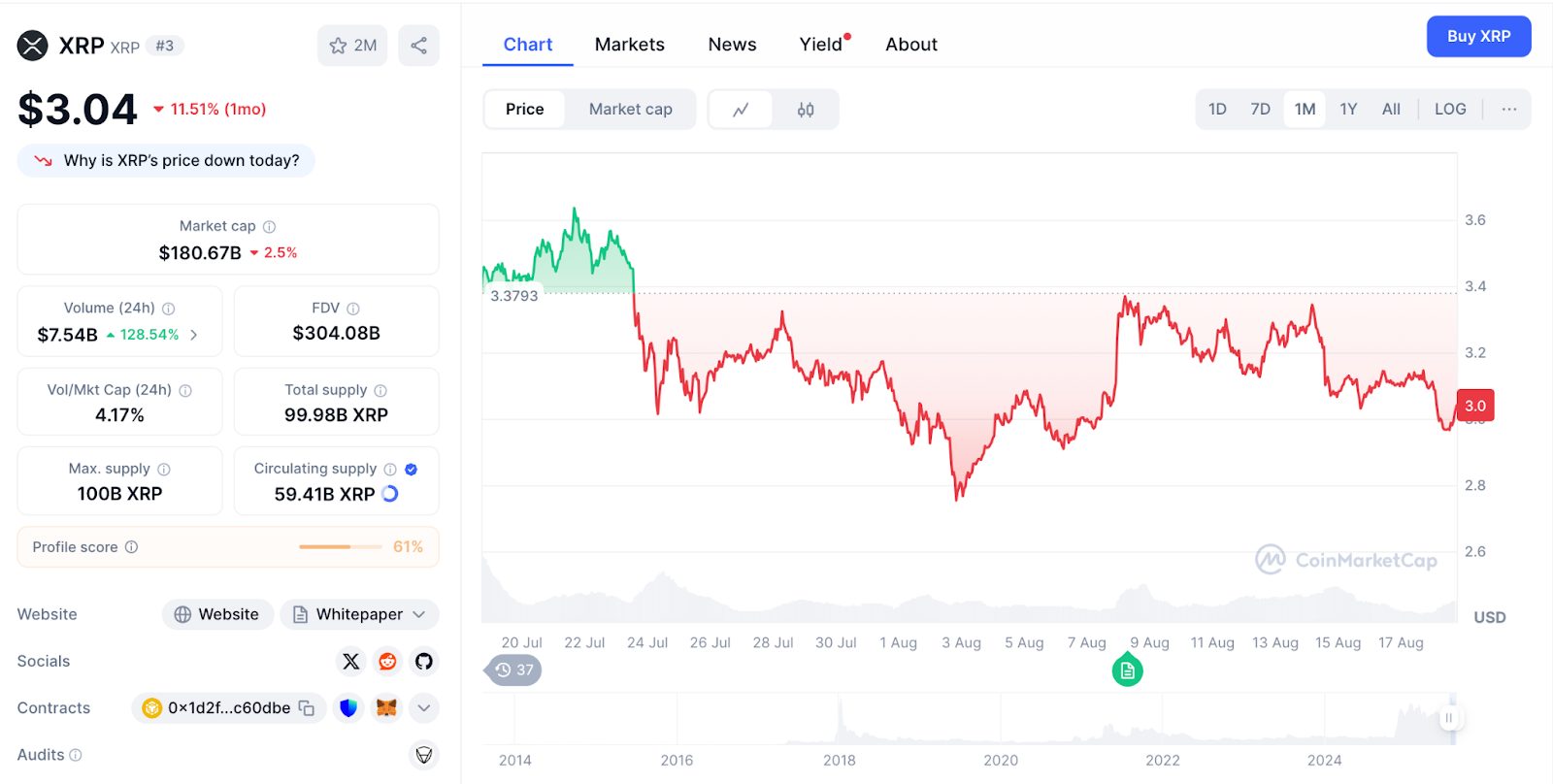

The 2025 trajectory shows considerable resilience with July’s $3.10 peak followed by August’s current $2.96 level, maintaining elevation within the $2.09–$3.10 range established since the March recovery.

The current pullback represents a natural correction following strong appreciation rather than a fundamental breakdown.

Market Fundamentals: Strong Metrics Despite Security Concerns

XRP maintains substantial market positioning with a $179.44 billion market cap despite the security report impact.

The market cap stability accompanies an exceptional volume surge to $7.48 billion, indicating active institutional repositioning during uncertainty periods.

The 10.15% volume-to-market cap ratio indicates exceptional trading activity, suggesting major institutional participation during the security-driven selloff.

This elevated activity typically accompanies major inflection points as participants reposition for directional clarity following fundamental reassessment.

Market dominance of 4.57% (+0.17%) demonstrates XRP’s strength relative to the broader crypto market during liquidation events.

LunarCrush data reveals cautious social performance with XRP’s AltRank declining to 542 during the security report processing.

A Galaxy Score of 52 reflects a temporary cooling of sentiment as participants assess blockchain security implications for institutional adoption prospects.

Engagement metrics show substantial activity with 10.51 million total engagements (+1.72M) and 47.28K mentions (+18.44K), demonstrating continued attention during technical challenges.

Social dominance of 4% maintains visibility, while sentiment registers at a robust 81% positive despite security concerns.

Recent social themes focus on Teucrium CEO’s bold predictions of Ripple becoming a top-20 global bank with 40 billion XRP holdings, and continued emphasis on the XRP Ledger’s infrastructure potential for tokenizing real-world assets despite security ranking challenges.

Major developments include Brad Garlinghouse’s prioritization of acquisitions over ETF applications and continued institutional infrastructure validation.

At the same time, technical analysts identify support defense opportunities at the current $2.96 level amid broader market uncertainty.

ChatGPT’s XRP Analysis: Key Support Defense Required

ChatGPT’s XRP analysis reveals XRP at a key juncture, testing the 50-day EMA support at $2.9422 following security report-driven selling pressure.

The support test represents a make-or-break moment for the continued bullish structure amid institutional uncertainty about blockchain security positioning.

Immediate support emerges at today’s low around $2.9404, requiring defense for bullish continuation toward a recovery.

The 50-day EMA at $2.9422 provides key technical support, while deeper support exists at the 100-day EMA ($2.7218) and the 200-day EMA ($2.4464), creating substantial downside protection.

Resistance begins at the 20-day EMA around $3.1042, followed by key resistance at $3.15–$3.25 levels.

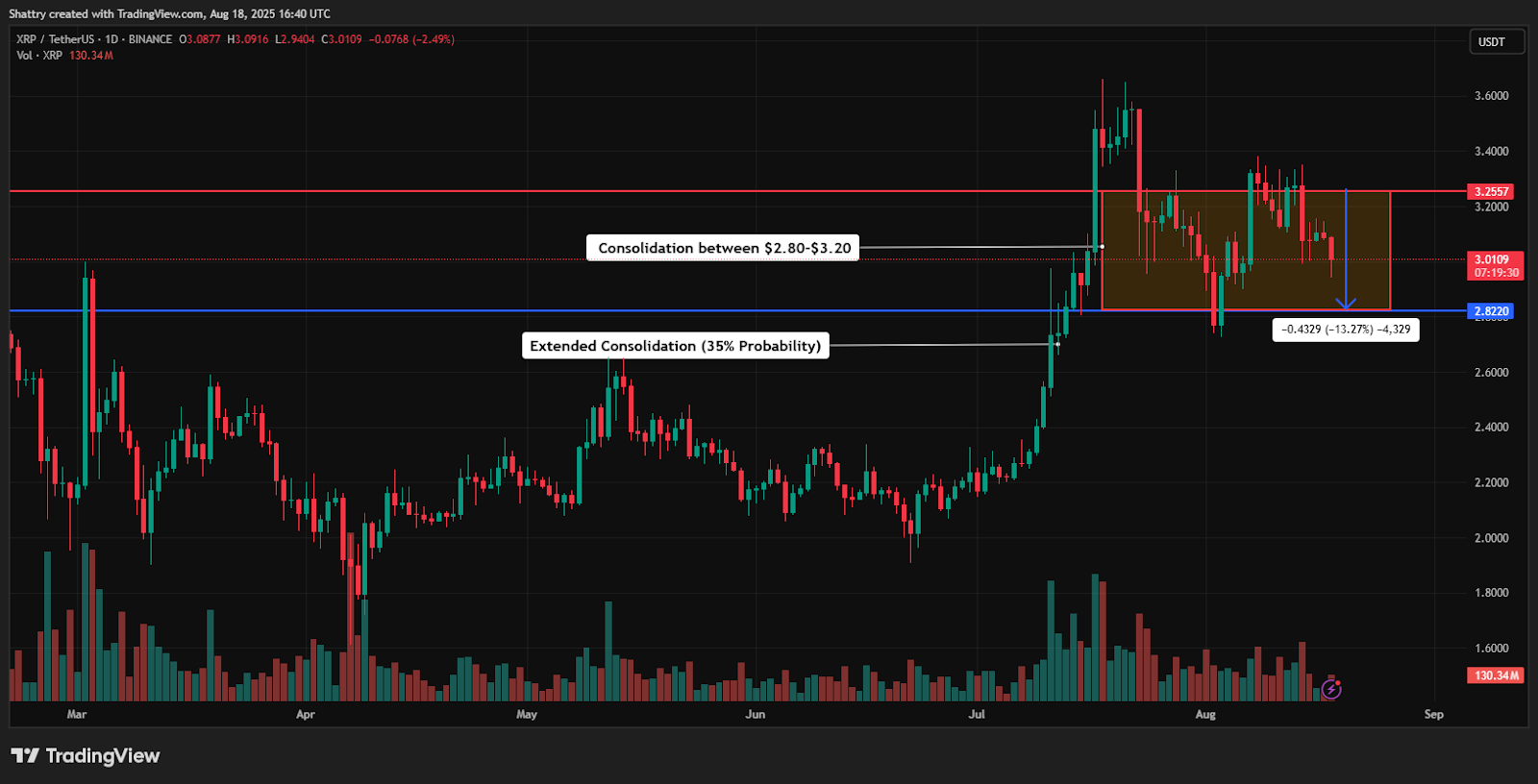

The technical setup suggests that key support defense at $2.94–$2.96 is required for bullish continuation, while a break below could trigger a deeper correction toward the $2.72–$2.85 major support zone as institutional repositioning accelerates.

Three-Month XRP Price Forecast: Recovery Scenarios

Support Defense Recovery (40% Probability)

Successful defense of the $2.94–$2.96 support, combined with security concern resolution, could drive recovery toward $3.25–$3.50, representing an 8–17% upside from current levels.

This scenario requires institutional confidence restoration and volume stabilization.

Extended Consolidation (35% Probability)

Continued security assessment processing could result in consolidation between $2.80 and $3.20, allowing technical indicators to reset while infrastructure development continues, addressing security perceptions.

Deeper Correction (25% Probability)

A break below the $2.94 support could trigger selling toward $2.72–$2.85 support levels, representing 8–12% downside.

Recovery would depend on the resolution of major support, defense, and security concerns.

ChatGPT’s XRP Analysis: Infrastructure Potential Meets Security Challenges

ChatGPT’s XRP analysis reveals XRP facing a key support test amid security report challenges to institutional confidence.

The pullback to the $2.94–$2.96 support represents institutional reassessment of blockchain security positioning versus infrastructure adoption potential.

Next Price Target: $3.25-$3.50 Within 90 Days

The immediate trajectory requires decisive defense of the $2.94 support to validate institutional confidence over security concerns.

From there, resolving security issues could propel XRP toward the $3.25 psychological resistance, with sustained institutional integration driving toward $3.50+ recovery levels.

However, failure to hold $2.94 would indicate a deeper correction to the $2.72–$2.85 range, creating an optimal accumulation opportunity before the next infrastructure wave drives XRP toward $4.80+ targets as institutional confidence returns.

The post ChatGPT’s XRP Analysis Flags $2.94 Support – Rebound Setup or Breakdown? appeared first on Cryptonews.

[title_words_as_hashtags

$360M in crypto longs liquidated as Bitcoin falls below $116, with over 100K traders eliminated, raising questions about a cyclical market top.

$360M in crypto longs liquidated as Bitcoin falls below $116, with over 100K traders eliminated, raising questions about a cyclical market top. Teucrium CEO reveals Ripple’s bold plan

Teucrium CEO reveals Ripple’s bold plan

|

| (@Xaif_Crypto)

(@Xaif_Crypto)