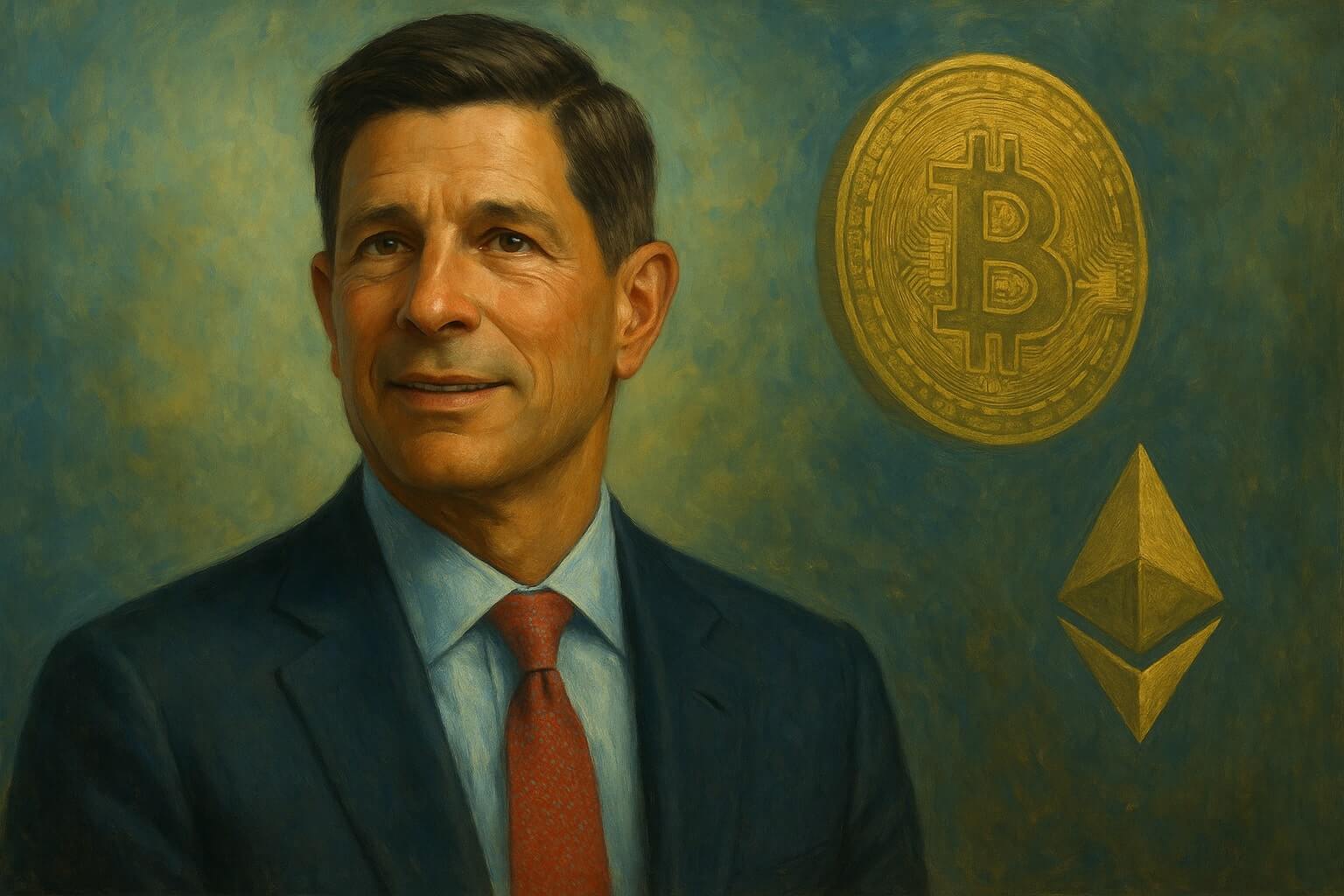

Charles Schwab CEO says Bitcoin, Ethereum trading coming soon

Charles Schwab CEO Rick Wurster confirmed the brokerage plans to add Bitcoin (BTC) and Ethereum (ETH) trading for its customers during an interview with CNBC on July 18.

According to Wurster, the move comes amid heavy client demand to see all their asset exposure in the same dashboard.

He said:

“Our clients are invested in crypto today.”

He explained that the firm’s customers already hold more than 20% of all crypto exchange‑traded products (ETPs) in the US, worth roughly $25 billion. However, this number amounts to only roughly 0.2% of the firm’s $10.8 trillion in total client balances.

Wurster’s remarks confirm reports from early May about the firm’s interest in crypto trading services.

Clients seek one‑stop custody

Wurster framed the spot Bitcoin and Ethereum access as a consolidation tool rather than a venture into speculative trading.

He said many households already keep 98% of their wealth at Schwab but maintain a small “one or two percent” slice at specialist crypto platforms so they can hold coins directly.

Charles Schwab’s CEO noted:

“They really want to bring it back to Schwab because they trust us.”

Furthermore, he said that customers prefer to view crypto alongside equities, bonds, and cash on a single dashboard.

Wurster expects the rollout to “accelerate our growth” because balances parked elsewhere would migrate once Schwab offers direct custody. He did not specify a launch date, saying only that the service will arrive “sometime soon.”

Direct rivalry with Coinbase

Asked whether the addition sets up a head‑to‑head contest with Coinbase, Wurster answered “absolutely.”

He said Schwab wants customers who currently buy coins at Coinbase to transfer those holdings back to Schwab, where the brokerage already provides round‑the‑clock service, research tools, and integrated portfolio reporting.

Schwab’s upcoming service will complement the crypto exposure it already supports through exchange‑traded products.

Wurster did not discuss fees, trade execution partners, or wallet architecture, but he emphasized that the firm will apply the same custody standards it uses for traditional securities.

Mentioned in this article

[title_words_as_hashtags