Michael Race & Sean FarringtonBusiness reporter & business presenter

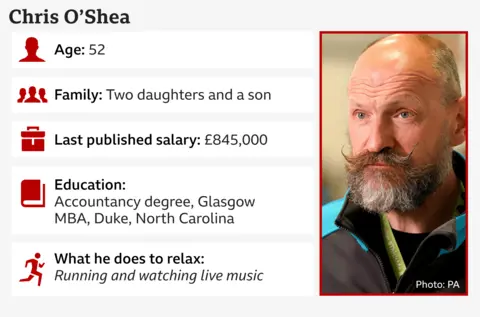

Chris O’Shea hasn’t lived in Scotland for decades but the boss of Centrica, the owner of British Gas, is worried over the future of the energy industry in his homeland.

He is concerned that the “demise” of drilling for gas and oil in the North Sea and the move to green energy will not create new roles quickly enough to offset job losses.

His wide-ranging interview with us follows a series of difficult moments for the industry as soaring energy prices pushed household bills up and saw bumper dividends to shareholders and pay packets to bosses – including him. British Gas also faced a scandal over force-fitting prepayment meters in the homes of vulnerable people who fell behind on bills, something he says the company doesn’t do anymore.

Today O’Shea says his big concern is the decline in jobs in the North Sea oil and gas industry. The UK’s largest oil and gas producer, Harbour Energy, announced job cuts earlier this year. And this month, the Port of Aberdeen said it would cut roles in the face of what it described as a “staggering” fall in North Sea oil and gas activity.

“The energy transition is the right thing for us to do. It’s essential,” says O’Shea, pointing out that British Gas no longer explores for oil and gas in the North Sea and benefits more from energy being imported from overseas.

That’s not to say he doesn’t think there should be more drilling in the North Sea.

“Whether you look at this from a cost point of view or whether you look at this from a carbon point of view or environmental point of view, the gas that you produce domestically will often be cheaper than the gas you import, and it will definitely be cleaner than the gas you import,” he says.

But going back to the transition to green energy, he tells the BBC’s Big Boss Interview that the question is over the pace at which it needs to happen, drawing on personal experience.

“I grew up in the town of Fife, which was surrounded by coal mines. I saw the devastation when the coal mines were closed during the miners’ strike and people that had incredibly well-paid jobs – they went to no work at all.

“You’ve got second, third-generation people that are not in work now. And I desperately want to avoid that through this transition.”

He says he found it quite hard to get a job after university and “got loads of rejection letters”.

“I know what it’s like to be a bit worried about getting a job,” he says.

“I also know what it’s like to get a job that you like, and you find out that you’re good at, it can change your life – it certainly did for me.”

However, the chief executive is no stranger to cutting roles, having axed the best part of 5,000 soon after he took charge during the height of the Covid pandemic in April 2020.

“I wasn’t sure the company was actually going to survive,” he says. “The only way I could justify that to myself was I was trying to protect 20,000 jobs, I couldn’t protect them all.”

Since then, Centrica has taken on 1,700 apprentices and has committed to taking on one more every day for this decade at least.

Much like energy prices in recent years, it’s been a volatile time in the hotseat for O’Shea.

As wholesale energy prices soared in part due to supply issues following the outbreak of war in Ukraine, many small suppliers went bust as they were unable to afford the fixed-price deals they’d locked into with customers.

“It’s all down to poor regulation,” O’Shea says, arguing that energy regulator Ofgem should have been stricter on making sure suppliers had enough cash to manage risks.

“You cannot have a system whereby the profits are privatised and the losses are socialised,” he says.

Ofgem told the BBC its regulation meant the sector “now holds around £7.5bn in assets, a significant reverse from -£1.7bn during the crisis, meaning they are now better protected against failure, and the impact this has on customer’s bills”.

As energy bills surged, there were questions over bumper dividends to shareholders, and O’Shea’s own salary and bonuses which hit £8.2m in 2023.

“Investors invest and they want a return,” he says. “People don’t put money in the bank and say, ‘it’s ok, don’t give me any interest’ and investors don’t buy shares and say, ‘it’s ok, don’t give me any return’.”

Those dividends, O’Shea argues, are not generated from British Gas customers, and are as a result of other parts of Centrica’s diversified business.

“There is very little profit that’s made in the energy retail business. You’re capped on the profit that you can make at 2.4% of your revenue,” he says.

The 52-year-old faced a huge public backlash after it emerged that debt agents working for British Gas were breaking into people’s homes to fit prepayment meters.

“We are not doing that at the moment,” he says when asked if this has resumed.

But he argues the regulator Ofgem needs to tell firms how to act when people don’t pay and how to find out who cannot pay and who refuses to.

“My heart goes out to those people who can’t pay, but those people who choose not to pay are freeloaders and we have to find a way to differentiate and go after the people who choose not to pay, and to remove the distress from people who are unable to pay,” he adds.

He seems supportive of potential plans for the chancellor to announce relief for billpayers in the Budget, such as cutting the current 5% rate of VAT charged on energy.

“Anything that reduces the cost of energy, I would welcome.

“But the reality is we have got to pay for it in some way,” he warns.