Ethereum Price Prediction: ETH’s 22% Weekly Surge Signals $5,000 Target – What’s Next for Bulls?

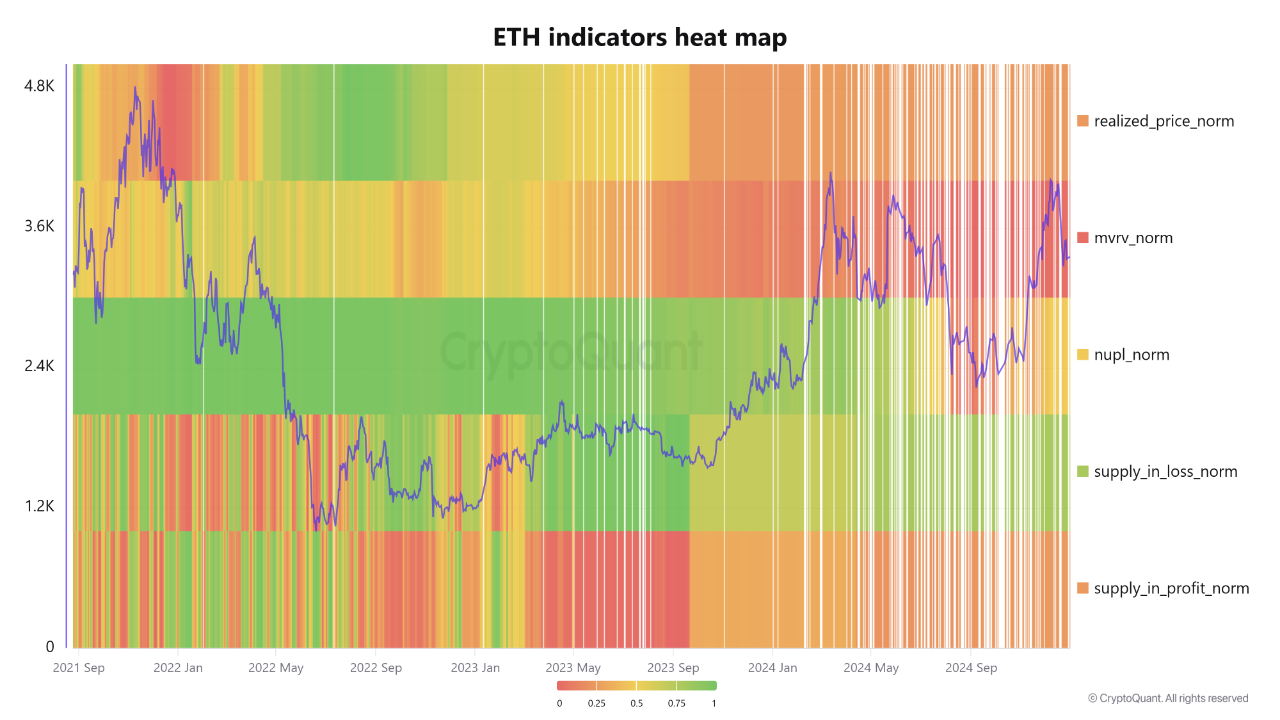

Ethereum (ETH) has continued to rise, up 22% over the past week and briefly touching $4,300 for the first time since November 2021. This is the biggest rally in nearly three years and is driven by retail enthusiasm, institutional accumulation and a supply backdrop shaped by staking.

With sentiment so bullish, traders are now looking at $5,000 as the next big target.

Retail is in Charge

Social media sentiment is pointing to a retail-led rally. Hashtags like #buying, #bullish and #higher are appearing almost twice as often as their bearish counterparts #selling and #lower.

According to Santiment, the bullish tone suggests strong retail participation but analysts warn that too much optimism can sometimes precede short term pullbacks.

Key points driving retail sentiment:

- ETH prices breaking multi year resistance

- Increased coverage and hype in trading communities

- Fear of missing out (FOMO) driving new entries

Institutions are Buying

Large investors have also played a big role in the Ethereum rally. Blockchain data from EmberCN shows that between July 10 and early August, whales and institutions accumulated 1.035 million ETH worth $4.17 billion at an average price of $3,546.

This buying coincided with a 45% move from $2,600 to $4,000, showing the scale and timing of institutional positioning. This kind of accumulation is long term confidence with many of these buyers looking to capture upside as the Ethereum ecosystem grows and staking yields remain attractive.

Ethereum Technicals: Bulls Eye $4,533 and Beyond

Ethereum price prediction continues to be bullish even if ETH is consolidating at $4,192 after breaking out above $3,872 earlier this month. On the 4-hour chart, price action has formed a series of higher lows within an ascending channel, supported by the 50-period SMA at $3,768. The latest move has broken the 1.618 Fibonacci extension at $4,193, which is now acting as support.

Candlestick patterns show small bodied bars with long upper wicks, a sign of profit taking without structural breakdown.

The RSI is 70.6, slightly overbought and increasing the chance of a pullback to $4,088 or $3,972 before continuing higher. The MACD is bullish and momentum is increasing.

Fibonacci targets:

- Initial resistance: $4,391

- Secondary target: $4,533

- Extended target: $4,712

A daily close above $4,391 on good volume could trigger breakout buying and accelerate the move to $4,533. If ETH holds $3,972 on closing timeframes, the bigger picture trend is still intact and $5,000 is in play for the next few months.

Supply Growth and Staking

Ethereum’s supply reached 121 million on August 9, nearly three years after 120 million. The network mints 2,500-3,000 ETH daily but staking is absorbing most of it. 36.18 million ETH is currently locked in staking contracts, reducing liquid supply and inflation pressure.

If demand and adoption keep up with supply growth, Ethereum’s rally could continue into year end if macro remains risk on.

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $8.1 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.0126, but that price is set to rise in the next 3 days.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale

The post Ethereum Price Prediction: ETH’s 22% Weekly Surge Signals $5,000 Target – What’s Next for Bulls? appeared first on Cryptonews.

[title_words_as_hashtags

(@Moonshot_scout)

(@Moonshot_scout)