Bitcoin Price Prediction: Bullish Flag and Policy Shifts Fuel $123K Breakout Hopes

Bitcoin is holding at $116,830 as mainstream adoption is taking off in the US. Sheetz, a popular convenience store chain with locations across multiple states, is offering 50% off all purchases between 3 pm and 7 pm when paid with cryptocurrency through Flexa.

The “Crypto Crave & Save” promotion is designed to get people spending real crypto in the real world, with payments converted to fiat instantly to protect merchants from volatility.

It’s spreading. Steak ‘n Shake just reported saving 50% on payment fees by using Bitcoin over credit cards. These are signs that US businesses are starting to view digital assets as not just investments but as functional payment tools.

Regulatory Divergence Between the U.S. and EU

Across the Atlantic, the European Banking Authority has finalized draft rules giving “unbacked” crypto assets like Bitcoin a 1,250% risk weight, meaning EU banks would need €12.5 million in capital for every €1 million in BTC holdings.

While the measure may limit crypto exposure in Europe, it also formalizes Bitcoin’s place in the financial system, a step analysts say could strengthen long-term adoption.

By contrast, U.S. policy is moving in the opposite direction. President Donald Trump announced plans to allow cryptocurrencies in 401(k) retirement plans, opening the door to a $9 trillion market. Ether rose 4% on the news, and crypto-related equities rallied, with Coinbase gaining 3%, Galaxy Digital 6%, and Bitmine Immersion 8%. Galaxy CEO Mike Novogratz called it a “milestone” for integrating digital assets into mainstream finance.

Bitcoin (BTC/USD) Technicals Signal Bullish Continuation

From a charting perspective, Bitcoin remains in a bullish flag pattern that has been consolidating since late July’s high of $123,255. The pattern’s lower bound aligns with an upward trendline from April and the 50-day SMA at $113,154 — a key support confluence that has drawn consistent buying interest.

Momentum is turning positive, with the daily RSI at 54 after bouncing from earlier oversold conditions. Defending the 0.382 Fibonacci retracement at $113,682 has reinforced the case for an upside move. A breakout above $117,350 could open a path back to $123,255, with further targets at $126,981 and $131,574.

If $113,150 fails, however, short-term sentiment may turn cautious, exposing $110,725 and $107,768. Traders eyeing an entry may look for a high-volume move through $117,350 to confirm the breakout.

Bitcoin Price Outlook into Q4

The combination of rising retail adoption, favorable U.S. policy shifts, and a supportive technical structure gives Bitcoin a bullish bias heading into the fourth quarter.

If the bullish flag resolves upward, it could mark the start of a new leg higher, potentially paving the way toward the $250K–$500K price projections some analysts are targeting for 2025.

With institutional and retail demand converging, BTC’s current consolidation may be less a pause than a launchpad.

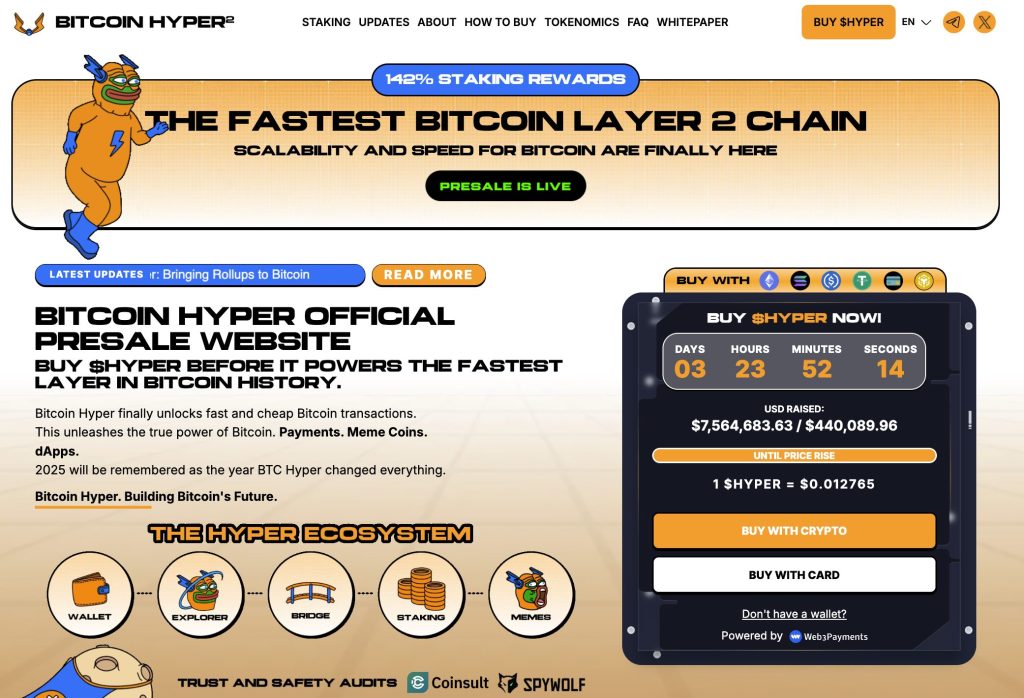

New Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) is the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), built to supercharge the Bitcoin ecosystem with fast, low-cost smart contracts, dApps, and meme coin creation.

By merging Bitcoin’s security with Solana’s performance, it unlocks powerful new use cases – all with seamless BTC bridging.

The project is audited by Consult and built for scalability, simplicity, and trust.

Investor interest is surging, with the presale already surpassing $7.4 million and only a small allocation remaining.

HYPER tokens are currently available at just $0.012765, but that price is set to rise in the next 3 days.

You can buy HYPER tokens on the official Bitcoin Hyper website using crypto or a bank card.

Click Here to Participate in the Presale[/cta

The post Bitcoin Price Prediction: Bullish Flag and Policy Shifts Fuel $123K Breakout Hopes appeared first on Cryptonews.

[title_words_as_hashtags

(@Mtitus6)

(@Mtitus6)