Winklevoss Twins Back Trump Brothers’ Bitcoin Mining Empire – Bloomberg

The Winklevoss twins, Cameron and Tyler, have reportedly invested in American Bitcoin Corp., a new crypto mining company tied to Eric Trump and Donald Trump Jr., according to a report by Bloomberg.

The venture, backed by a private placement, combines assets from Hut 8 Corp. and an entity linked to the Trump sons.

The exact size of the Winklevoss twins’ investment was not disclosed, but Asher Genoot, CEO of Hut 8, confirmed it was part of a recently closed private placement.

That round reportedly raised about $220 million in a mix of cash and Bitcoin. Genoot described it as “oversubscribed” during the company’s latest earnings call.

American Bitcoin Corp Targets Public Listing With Winklevoss Investment and Trump Ties

American Bitcoin Corp. launched in March through a partnership with publicly traded miner Hut 8, which currently holds an 80% stake in the venture. The remaining 20% is controlled by American Data Centers, a firm backed by Eric Trump and Donald Trump Jr.

Eric Trump serves as the chief strategy officer of the company. He is also expected to see his equity stake rise in value when the company goes public, with Bloomberg previously reporting it could be worth as much as $367 million.

American Bitcoin has announced plans to go public via an all-stock merger with Nasdaq-listed Gryphon Digital Mining Inc. The merged entity is expected to trade under the ticker symbol “ABTC.” The transaction is targeted to close by early September, pending shareholder approval.

Shareholders of Gryphon began voting this week on the proposed merger. If approved, American Bitcoin will emerge as a new player on the Nasdaq with a focus on building a strategic Bitcoin reserve through its mining operations.

American Bitcoin plans to build up a reserve of mined Bitcoin, positioning itself as both a mining and holding firm.

The twins, who run Gemini Exchange and have long been vocal supporters of Bitcoin, made their contribution in BTC, according to the same report. A Gemini spokesperson declined to comment.

The investment also indicates a deepening alignment between the Trump family and the Winklevoss twins. The twins have previously donated to Donald Trump’s campaign and were seen at a crypto summit hosted at the White House in March.

They also attended the signing of recent crypto legislation, part of broader industry engagement with policymakers. While the merger still requires shareholder approval, Genoot said the firm expects the transaction to close on schedule.

“We believe this structure gives us the scale, capital, and leadership to build something that can stand at the center of American crypto mining,” he said.

As of now, American Bitcoin’s next step is completing its public listing under the ABTC ticker. If successful, it will become one of the most politically connected mining firms in the country, backed by some of the most recognizable names in both crypto and American politics.

American Bitcoin Leverages $220M Raise to Expand Strategic BTC Mining Footprint

On July 1, American Bitcoin announced it had raised $220 million, which marked a major move in its mining ambitions. The venture was launched with a focus on large-scale Bitcoin mining and building strategic BTC reserves.

A recent filing by Hut 8 Corp. confirmed that a portion of the funds had already been deployed. Specifically, around $10 million worth of newly issued equity was sold for Bitcoin instead of dollars, hinting at a deeper accumulation strategy.

Donald Trump Jr. previously noted that mining, not just holding Bitcoin, would play a major role in the broader opportunity the asset represents, especially when economic conditions support it.

While American Bitcoin ramps up, the broader mining sector is still shaped by China’s deep-rooted legacy in the space. Despite Beijing’s 2021 crackdown, the Chinese capital and manufacturing continue to dominate hardware supply chains.

Companies like Bitmain and MicroBT, which once led domestic mining operations, have since shifted production to the U.S., contributing to America’s rise from 4% to 38% share in global hashrate.

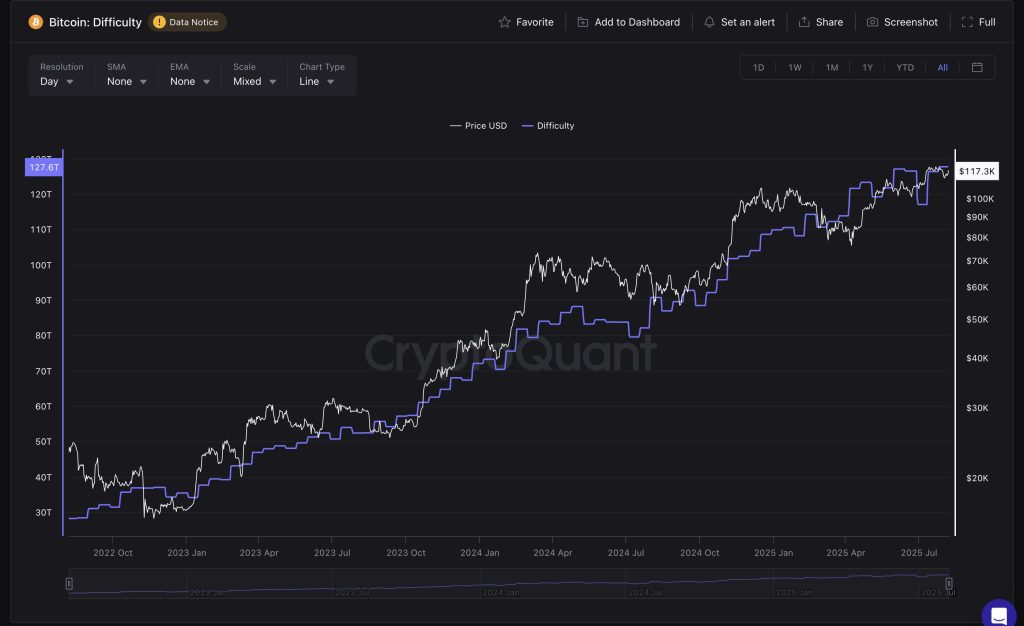

Meanwhile, Bitcoin mining difficulty, a key indicator of network competition, has fluctuated in recent weeks. Bitcoin mining difficulty reached a new all-time high of 127.6 trillion on August 2, but it is expected to decline slightly in the next adjustment on August 9.

Estimates suggest a 3% drop to around 123.7 trillion, with average block times currently at 10 minutes and 20 seconds, according to CoinWarz.

CryptoQuant data show mining difficulty dropped in late June and the first half of July, reaching a low of 116.9 trillion. However, the trend reversed in late July as difficulty resumed its upward trajectory.

As mining economics tighten and competition intensifies, players like American Bitcoin are positioning to benefit from both accumulation strategies and the physical infrastructure that underpins Bitcoin’s network.

The post Winklevoss Twins Back Trump Brothers’ Bitcoin Mining Empire – Bloomberg appeared first on Cryptonews.

[title_words_as_hashtags

Trump son Eric Trump-backed American Bitcoin intends to use the net proceeds from $220 million raised in a new share issuance to fund for Bitcoin equipment purchase.

Trump son Eric Trump-backed American Bitcoin intends to use the net proceeds from $220 million raised in a new share issuance to fund for Bitcoin equipment purchase.