Caldera Price Prediction: Is ERA About to Pump in July 2025 As Coinbase Adds ERC-20 Support?

Coinbase is the latest of a suite of major exchange listings for ERA, adding weight to a bullish June Caldera price outlook with previously untapped demand.

The impact is already showing: the altcoin has surged 64% over the past 24 hours, outpacing the top 300 cryptocurrencies in a clear buy-the-news event.

ERA has fallen 30% since its peak as the Caldera Foundation opened for claims for its 70 million ERA airdrop, prompting holders to offload tokens for an immediate gain.

Coinbase uses the ‘Experimental Label’ to flag tokens that are new or have low trading volume, making them more susceptible to price volatility.

Geopolitical and macroeconomic FUD no longer cloud the narrative, with ever-closer regulatory clarity amid “Crypto Week” fueling a capital rotation into riskier assets.

Caldera Price Analysis: Can ERA Keep Pumping Through July?

Once the airdrop claims conclude, selling pressure may ease, allowing ERA to establish a more stable foundation for continued growth.

The altcoin is currently testing for a new higher low, with potential support forming around $1.35. The outcome here could define whether a broader downtrend resumes or a new leg up begins.

RSI readings remain low in the 40s, suggesting sellers still have the upper hand. With just over 24 hours of price action available, any near-term outlook remains highly speculative.

Fundamentals are currently the best indicator of Caldera’s staying power. The Caldera network already integrated over 50 rollups, powering projects like ApeChain, Kinto, Sanko, and Manta.

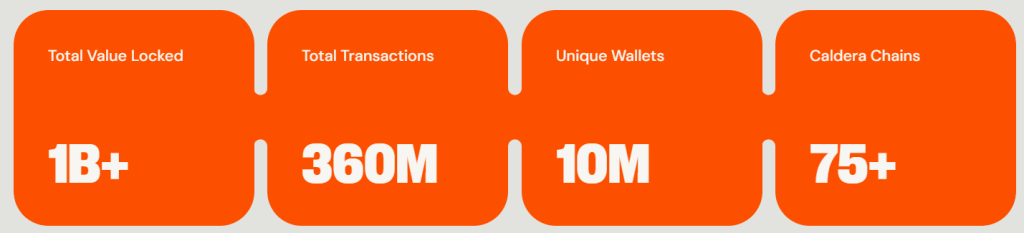

Through these rollups, Caldera reports over $1 billion in total value locked, processing over 360 million transactions from 10 million wallets.

Ethereum layer-2 solutions currently manage over $40 billion, a market Caldera could have a claim to with adoption due to supportive regulatory frameworks emerging from “Crypto Week.”

At a $216 million market cap, Caldera has considerable upside potential, but short-term sell pressure from the airdrop remains the main headwind for the rest of July.

Latecomers Missed the Initial Rally – Here’s How to Get Ahead of Others

With altcoin season in full swing and a wave of retail liquidity flowing into riskier plays, the meme coin scene is printing 10-100x plays, but with volatility comes risk.

That’s where Snorter ($SNORT) steps in. Its purpose-built trading bot is engineered to spot early momentum, helping investors get in before the crowd, where the real gains are made.

While trading bots are not a new concept, Snorter has been designed specifically for sniping with limit orders, MEV-resistant token swaps, copy trading, and even rug-pull protection.

It’s one thing to get in first, it’s another thing to know when to sell—Snorter Bot can help.

The project is off to a strong start—$SNORT has already raised over $1.7 million in its initial presale weeks, likely driven by its high 196% APY on staking to rewards early investors.

You can keep up with Snorter on X, Instagram, or join the presale on the Snorter website.

The post Caldera Price Prediction: Is ERA About to Pump in July 2025 As Coinbase Adds ERC-20 Support? appeared first on Cryptonews.

[title_words_as_hashtags