Nation’s largest teachers union votes to sever ties with Anti-Defamation League over Israel support

NEWYou can now listen to Fox News articles!

America’s largest teachers union has severed ties with the Anti-Defamation League (ADL) over its decades-long ties to Israel, prompting the civil rights group’s CEO Jonathan Greenblatt to fire back at the union he says has been “overtaken” by activists.

“These individuals are there to teach our children in the classroom the basics of reading and writing and arithmetic, not radicalism, but that’s exactly what’s happened,” Greenblatt said of the National Education Association (NEA) on “Fox & Friends” Wednesday.

The organization, whose leadership holds a history of supporting left-wing causes, voted to suspend its ties to the ADL over the war in Gaza, according to reporting from Axios.

ADL URGES AMERICANS TO FIGHT HATE AFTER DEADLY SHOOTING IN DC

Former US Vice President Kamala Harris, right, waves with Becky Pringle, president of the National Education Association, at the National Education Association 2022 annual meeting and representative assembly in Chicago, Illinois, US, on Tuesday, July 5, 2022. (Photographer: Tannen Maury/EPA/Bloomberg via Getty Images)

The union will no longer use ADL-provided material regarding the Holocaust or antisemitism and will forego using or promoting any other ADL-affiliated material or programs.

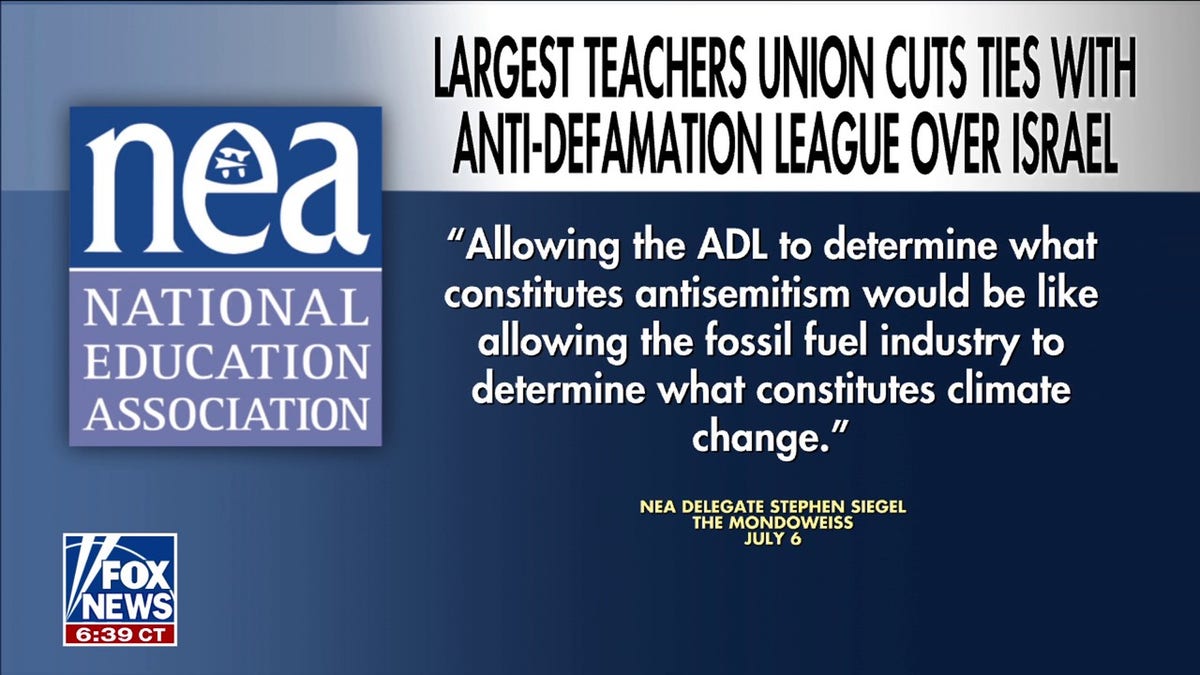

“Allowing the ADL to determine what constitutes antisemitism would be like allowing the fossil fuel industry to determine what constitutes climate change,” NEA delegate Stephen Siegel said from the assembly floor.

TEACHERS UNION BOSSES SPLIT OVER SUPREME COURT RULING ON PARENTAL RIGHTS TO SHIELD KIDS FROM LGBTQ CONTENT

NEA delegate Stephen Siegel made remarks on severing ties with the ADL. (Fox & Friends/Screengrab)

The decision earned support from CAIR (Council on American-Islamic Relations), who applauded the decision for sparing students from “biased materials” rife with “anti-Palestinian rhetoric.”

“We’ve seen an explosion of antisemitism in this country… Anti-Jewish acts of harassment, vandalism and violence have skyrocketed,” Greenblatt told “Fox & Friends” guest host Charlie Hurt.

CLICK HERE TO GET THE FOX NEWS APP

“Last year was the worst year we’ve ever tracked at ADL and yet, somehow, these teachers think the answer is to isolate Jewish students, to intimidate other Jewish educators and to target the oldest organization in the country fighting antisemitism. It’s bewildering, but it’s bigotry.”

He suspected that the “real motivation” behind the move is “insidious” anti-Israel activists working to “capture the culture” by indoctrinating children.

“Could you imagine telling the NAACP they’re not credible on racism, or the National Constitution Center, they can’t teach the Constitution? ADL’s materials are the gold standard. They’re peer-reviewed. We’ve been doing it for decades, and we’re teaching about the Holocaust.”

[title_words_as_hashtags