DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading

DeFiLlama has removed perpetual futures volume data for Aster, a decentralized exchange backed by figures linked to former Binance CEO Changpeng Zhao, after detecting trading volumes that mirrored Binance’s nearly 1:1 across multiple trading pairs.

Co-founder 0xngmi announced the delisting on October 5, 2025, citing concerns over data integrity.

According to the announcement, Aster’s volumes for pairs like XRP/USDT matched Binance perpetual volumes with a correlation ratio of approximately 1, whereas competitor Hyperliquid showed decorrelation in similar pairs.

The analytics platform cannot access lower-level data, such as maker and taker order information from Aster, to verify whether wash trading occurred, prompting the temporary removal until such verification becomes possible.

0xngmi noted that correlation patterns appeared even more extreme for other assets, such as ETH, with similar patterns visible across all trading pairs.

The DeFiLlama co-founder emphasized that the decision centered on maintaining data integrity for users who make investing decisions based on the platform’s analytics.

Crypto Community Splits Between Wash Trading Accusations and Liquidity Migration Defense

The delisting triggered sharp divisions within the crypto community, with critics questioning DeFiLlama’s centralization while defenders attributed the correlation to legitimate liquidity migration from Binance.

Blockchain investigator ZachXBT criticized industry figure Anndy Lian for normalizing wash trading, after Lian argued that “all crypto projects have washed trades” and questioned why observers were “acting so saintly” about the situation.

Lian, who holds positions in both leading perpetual DEX tokens, claimed that most projects are not fully decentralized and that alignment in open interest and price action is common across top projects that draw charts similar to Bitcoin.

He argued that if a project and its backers agree to spend money acquiring market share, the level of spending is their prerogative.

ZachXBT countered that Lian’s post history showed zero mentions of HYPE and only two posts referencing Hyperliquid, where Aster was also mentioned, while almost every other post focused on Aster.

Supporters of Aster argued that Binance’s liquidity was moved on-chain to the platform, explaining why volumes appeared to be synchronized.

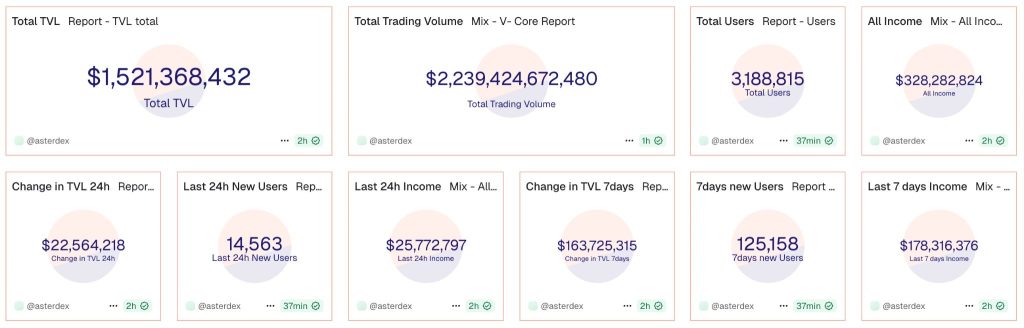

Multiple community members pointed to Dune Analytics data showing Aster’s total trading volume exceeding $2.2 trillion, with a total value locked of $1.52 billion, 3.18 million total users, and $328.28 million in all-time income.

The platform added 14,563 new users in the last 24 hours and 125,158 over seven days, according to the dashboard.

Dashboard creator Odbtc clarified that he used DeFiLlama’s public API as the data source, while Dune served only as a visualization layer to compare Aster, Hyperliquid, and Lighter.

He defended DeFiLlama’s decision, noting that the platform aggregates protocol-reported data while Dune allows users to query or visualize it, with dashboard quality depending entirely on the builder’s query logic.

Aster Launches Stage 3 Rewards Program as Binance Confirms Listing

Aster concluded its Genesis Stage 2 rewards program on October 5 and immediately launched Stage 3 Dawn, offering participants either their ASTER airdrop or a full refund of Stage 2 trading fees.

The claim page opens on October 10 for 48 hours, with airdropped tokens available on October 14.

Stage 3 runs for five weeks, ending November 9, introducing spot trading rewards, multi-dimensional scoring, symbol-specific boost multipliers, and team boosts that accumulate throughout the stage rather than resetting weekly.

At the same time, Binance announced it will list ASTER with a Seed Tag applied, while Aster implemented VIP fee tier updates starting October 6.

The platform updated its Market Maker Program with preferential fees and a monthly reward pool to strengthen liquidity.

The moves come as Aster recorded $493.61 billion in 30-day trading volume according to earlier DeFiLlama data, capturing nearly 50% of the perpetual DEX market share before the delisting.

At the time of publication, ASTER trades at $2.08 with a fully diluted valuation of $16.5 billion, having increased by over 29 times within four days following CZ’s endorsement, before reaching above $2.

The token was launched with an initial fully diluted valuation of $560 million at its token generation event.

On the other end, Hyperliquid’s HYPE token trades at $48.89 with a fully diluted valuation of $48.9 billion, maintaining approximately 70% of the perpetual DEX market share despite rising competition.

The post DefiLlama to Delist Aster Volume Data Over Suspected Wash Trading appeared first on Cryptonews.

[title_words_as_hashtags

Perp DEXs hit $1 trillion monthly volume for the first time as Aster and Hyperliquid lead a surge challenging centralized exchange dominance.

Perp DEXs hit $1 trillion monthly volume for the first time as Aster and Hyperliquid lead a surge challenging centralized exchange dominance.