Avalanche’s native token, $AVAX, has struggled to maintain momentum despite an 8.6% gain over the past week.

Launched in September 2020 as a scalable alternative to Ethereum for decentralized applications (dApps) and smart contracts, Avalanche has become one of the top 15 cryptocurrencies globally, boasting a market capitalization exceeding $9.2 billion.

As of press time, $AVAX trades at approximately $22.15, still down roughly 51% from its yearly high of $44.09, recorded on January 6.

Avalanche Network Activity Declines Sharply, But Standard Chartered Sees $AVAX Trading at $250 by 2029—Here’s Why

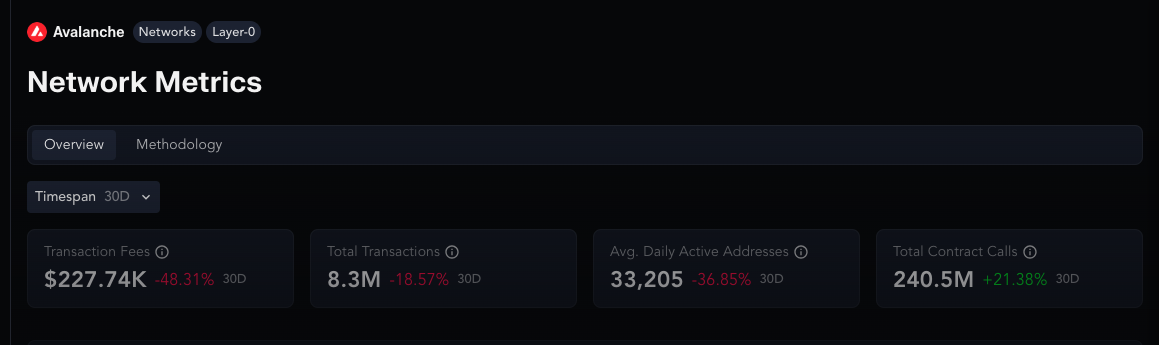

Network performance metrics indicate a noticeable drop in user activity across the Avalanche ecosystem.

According to Messari, total transactions on the chain have plummeted by over 48% in the last 30 days to just 227,400.

Meanwhile, the number of active daily addresses has dropped 36.85%, averaging only 33,265 unique users.

The only encouraging on-chain metric appears to be developer activity, with more than 250 million smart contract requests processed in the last 30 days, reflecting a 21.38% increase.

Despite weak usage data, Standard Chartered has issued a bullish long-term outlook. In a recent report, the bank forecast that $AVAX could climb to $250 by the end of 2029.

Geoff Kendrick, Head of Digital Assets Research, credited the network’s modular architecture and scaling solutions as key drivers of future growth.

He also emphasized that Avalanche’s relatively small market cap could amplify the impact of technical upgrades and adoption.

According to Standard Chartered, $AVAX could rise to $55 by the end of 2025, marking over 60% upside from current prices.

The bank further projected milestones of $100 in 2026, $150 in 2027, and $200 in 2028, assuming steady development and broader crypto market participation.

Bitget Partnership Targets India’s Web3 Growth

Adding to the momentum, Bitget revealed a strategic collaboration with Avalanche on April 28.

The partnership seeks to accelerate Web3 adoption at the grassroots level across India, including welfare distribution and microgrant programs in partnership with government entities.

This follows the March report that India’s Dantewada district digitized more than 700,000 land records, some dating to the 1950s, using Avalanche’s tamper-proof blockchain protocol.

Avalanche’s visibility was further boosted when Nasdaq filed Form 19b-4 with the U.S. SEC to list and trade Grayscale’s Avalanche Trust as an exchange-traded fund (ETF).

If approved, the ETF would allow regulated access to $AVAX for institutional and retail investors alike.

$AVAX Double Bottom and ABCD Pattern Point to Breakout Toward $28.87

From a technical perspective, AVAX/$USDT appears to have formed a double bottom near the $15 level, a bullish reversal pattern.

This pattern was followed by higher highs and higher lows, an early sign of a bullish trend reversal.

The setup is complemented by a well-formed ABCD harmonic pattern terminating around $23.38.

A breakout above this resistance could send prices toward $28.87, a projected 22.85% gain that aligns with prior price action.

The Relative Strength Index (RSI) currently hovers around 52, slightly bullish but not overbought, indicating there’s still room for upward movement if momentum builds.

However, failure to break above $23.38 and a retreat below $20 could indicate weakness, potentially dragging $AVAX back toward support near $17.50 or even $15.

The post $AVAX Eyes Higher Low Formation After Week-Long Consolidation — Is a 22% Rally on the Table? appeared first on Cryptonews.

#AVAX #Eyes #Higher #Formation #WeekLong #Consolidation #Rally #Table

https://t.co/skH8S9G5uU

https://t.co/skH8S9G5uU

My Target Zone is $105-145

My Target Zone is $105-145